Other categories I track my spending in, but don’t have a set amount allocated for.

Ynab budgeting reimburseable expeses how to#

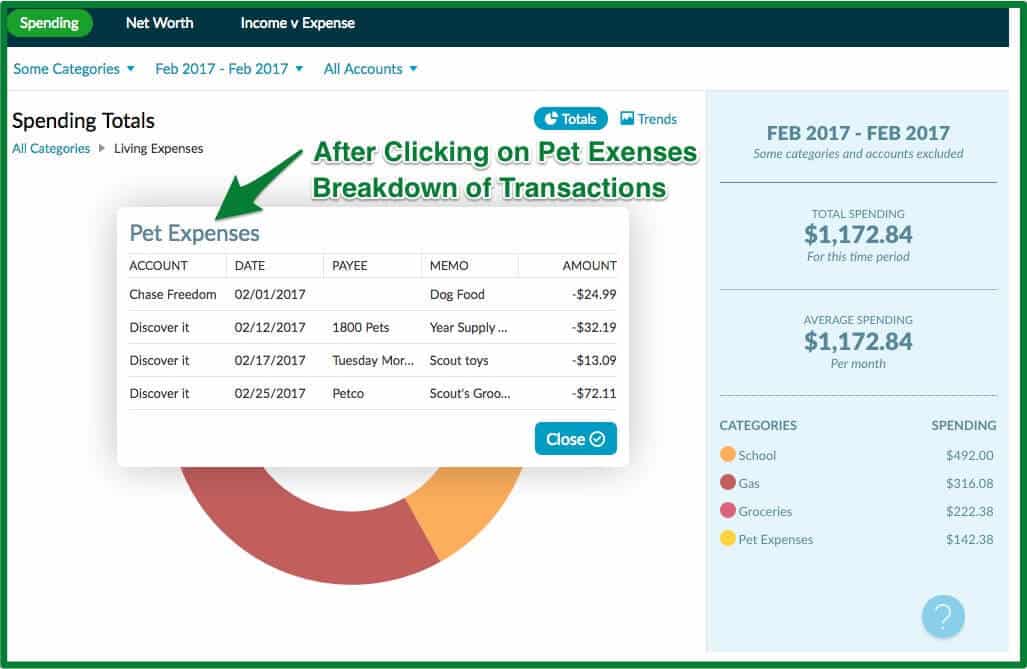

Then I can determine how to adjust course to address these overspent areas. It helps me discern if overspending in certain categories is due to my habits or perhaps to activities that my partner and I participate in too often or too lavishly. This is how I keep track of money I spend on myself and money I spend on myself + my partner.

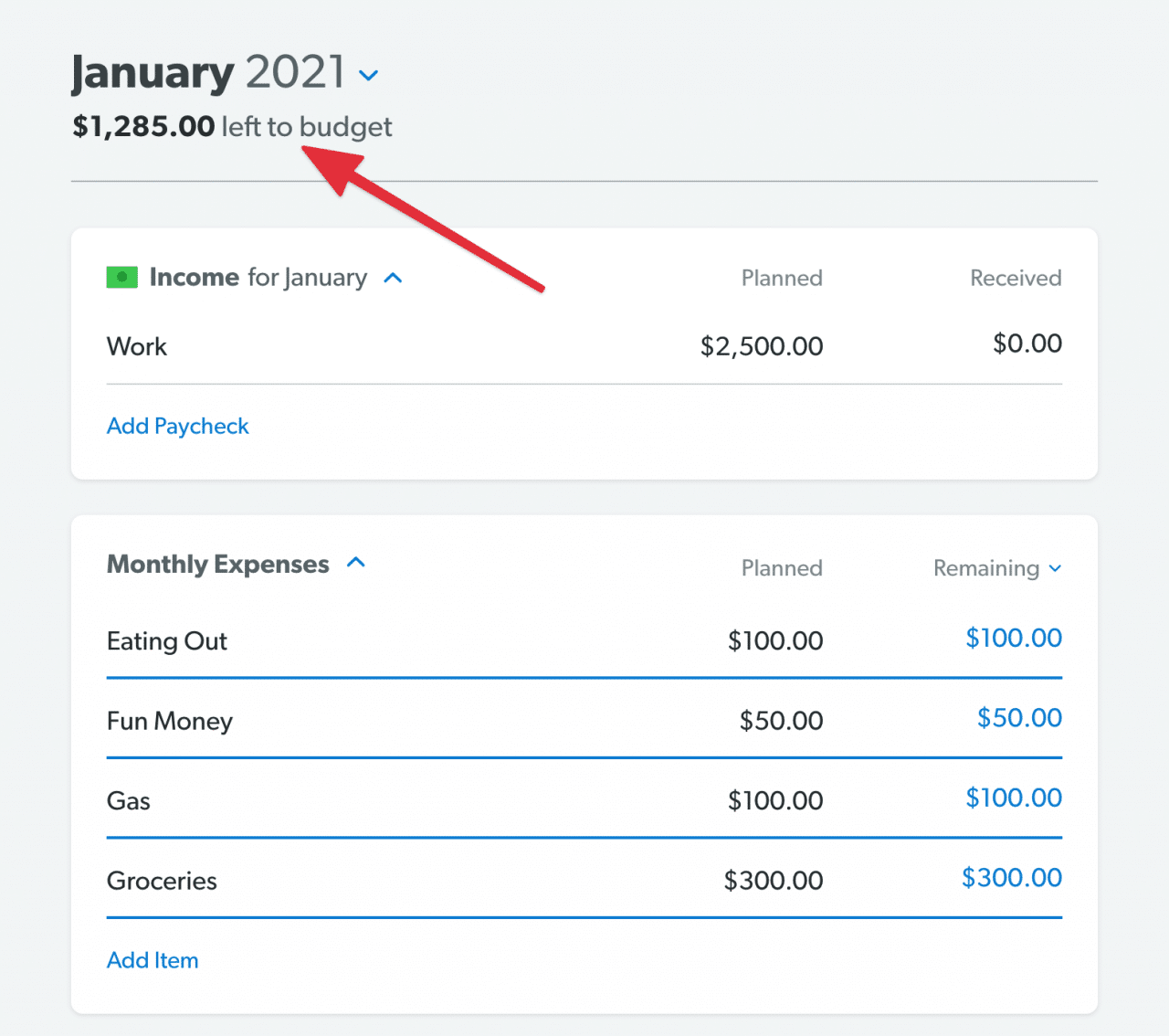

High Interest Loans Minimum Payment – $7,025.76 Low Interest Loans Minimum Payment – $790.30 Quarterly Spending Plan reviews to follow.Ī Spending Plan is a guideline that helps you spend your money in accordance with your values. On a quarterly basis, I check my progress with regards to my yearly allocation using my Spending Plan spreadsheet. That’s when I pay my bills, evaluate my spending according to my Spending Plan, tweak the Spending Plan for the coming month(s), and determine my additional student loan payment. On a monthly basis, I review my finances using a program called You Need a Budget, fondly abbreviated YNAB. I created a nifty spreadsheet (yes, I just used the word nifty to describe a spreadsheet… I’m a hopeless nerd) to store the categories and amounts, making tweaking it easy and checking progress a breeze. This is one of the ways my Spending Plan really comes in handy – it gives me permission to spend a certain amount of money on things I want to – and any extra income I make can be put towards my student loans/emergency fund/vacation fund with no feeling of deprivation. Once I pay off all of my high interest loans – hopefully in less than 2 years – this “leftover” money is going to be diverted towards my various saving goals. Since November 2015, my student loan payment was always everything that was left over once my bills were paid. This year, my huge goal is to pay off all of my remaining high interest student loans.

This goal will inspire you to stick to your spending plan, and it will drive you to figure out more creative ways to cut expenses in areas that aren’t important to you while increasing your earnings and savings rate. Do you want to save an emergency fund? Start investing in your 401k? Max out your retirement accounts? Save for a downpayment on your first rental property? Pay off all of your student loans? All of the above (OK, tiger)? You get the idea. The most important thing to decide when creating your spending plan for the new year is what your overarching financial goals are.

For example, to maintain my health through physical activity, I’ve planned to spend a lot of money on Sports. I’ve also aligned my spending categories and my goals, short-term and long-term. You guessed it, Enjoying Life is more than twice as large as Objects. You can probably guess which category allows more spending. Therefore, there’s literally one category in my Spending Plan called Enjoying Life and another called Objects. I made sure that my Spending Plan categories align with my overall values – such as valuing experiences over objects. My 2017 Spending Plan is based off of both my 2016 Spending Plan and my actual 2016 spending + some educated guesses about additional expenditures due to changes in circumstances or new spending categories. In 2017, I plan to harness the power of a Spending Plan to pay off almost $32,000 in student loans while still having fun and enjoying my twenties! That leaves me with $850 per month for living expenses – which I’ve allocated in alignment with my goals and values as detailed below.

0 kommentar(er)

0 kommentar(er)